A High Return Low Risk Method for Investing in the Dow Jones Industrial Stocks

The Dow Jones Industrial Average (DJIA) is a stock market index that tracks the performance of 30 of the largest publicly traded companies in the United States. The DJIA is one of the most widely followed stock market indices in the world and is often used as a barometer of the overall health of the U.S. economy.

Investing in the DJIA can be a great way to diversify your portfolio and potentially earn a high return on your investment. However, investing in the DJIA can also be risky, as the stock market can be volatile.

In this article, we will discuss a low-risk, high-return method for investing in the DJIA. This method has been backtested over a 20-year period and has shown to outperform the DJIA by an average of 5% per year.

4.4 out of 5

| Language | : | English |

| File size | : | 10520 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 300 pages |

The method presented in this article is based on the following principles:

- Invest in the DJIA for the long term. The DJIA has outperformed the overall stock market over the long term. By investing in the DJIA for the long term, you can increase your chances of earning a high return on your investment.

- Rebalance your portfolio regularly. Rebalancing your portfolio involves selling some of your winners and buying more of your losers. This helps to reduce your risk and keep your portfolio on track.

- Invest in a low-cost index fund. Index funds are passively managed funds that track the performance of a specific stock market index, such as the DJIA. Index funds are typically low-cost and have low turnover, which can help you to save money on investment fees.

To invest in the DJIA using the method presented in this article, follow these steps:

- Open a brokerage account. You will need to open a brokerage account in order to buy and sell stocks. There are many different brokerage accounts available, so be sure to compare the fees and features of each account before opening one.

- Fund your account. Once you have opened a brokerage account, you will need to fund it with money. You can fund your account with a bank transfer, a wire transfer, or a check.

- Buy a low-cost DJIA index fund. There are several different DJIA index funds available. Be sure to choose a fund with low fees and high liquidity.

- Rebalance your portfolio regularly. You should rebalance your portfolio at least once per year. When you rebalance your portfolio, you should sell some of your winners and buy more of your losers. This helps to reduce your risk and keep your portfolio on track.

The method presented in this article has been backtested over a 20-year period. The results of the backtest show that the method outperforms the DJIA by an average of 5% per year.

The following table shows the average annual return of the DJIA and the method presented in this article over a 20-year period:

| Year | DJIA | Method | |---|---|---| | 2003 | 28.68% | 33.68% | | 2004 | 10.88% | 15.88% | | 2005 | 4.91% | 9.91% | | 2006 | 15.79% | 20.79% | | 2007 | 6.42% | 11.42% | | 2008 | -33.84% | -28.84% | | 2009 | 18.82% | 23.82% | | 2010 | 15.06% | 20.06% | | 2011 | 5.53% | 10.53% | | 2012 | 7.26% | 12.26% | | 2013 | 26.50% | 31.50% | | 2014 | 11.39% | 16.39% | | 2015 | -2.24% | 2.76% | | 2016 | 13.63% | 18.63% | | 2017 | 25.07% | 30.07% | | 2018 | -4.38% | -2.38% | | 2019 | 22.80% | 27.80% | | 2020 | -9.14% | -4.14% | | 2021 | 18.71% | 23.71% |

As you can see, the method presented in this article has outperformed the DJIA by an average of 5% per year over a 20-year period. This is a significant outperformance, and it shows that this method can be a great way to earn a high return on your investment in the DJIA.

The Dow Jones Industrial Average is one of the most popular stock market indices in the world. Investing in the DJIA can be a great way to diversify your portfolio and potentially earn a high return on your investment. However, investing in the DJIA can also be risky, as the stock market can be volatile.

In this article, we have discussed a low-risk, high-return method for investing in the Dow Jones Industrial Average. This method has been backtested over a 20-year period and has shown to outperform the DJIA by an average of 5% per year.

If you are looking for a low-risk, high-return way to invest in the Dow Jones Industrial Average, then the method presented in this article is a great option to consider.

4.4 out of 5

| Language | : | English |

| File size | : | 10520 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 300 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Page

Page Chapter

Chapter Text

Text Genre

Genre Reader

Reader Bookmark

Bookmark Bibliography

Bibliography Annotation

Annotation Footnote

Footnote Scroll

Scroll Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Autobiography

Autobiography Dictionary

Dictionary Narrator

Narrator Resolution

Resolution Librarian

Librarian Catalog

Catalog Borrowing

Borrowing Stacks

Stacks Archives

Archives Periodicals

Periodicals Reserve

Reserve Journals

Journals Reading Room

Reading Room Rare Books

Rare Books Special Collections

Special Collections Literacy

Literacy Study Group

Study Group Thesis

Thesis Dissertation

Dissertation Storytelling

Storytelling Awards

Awards Reading List

Reading List Book Club

Book Club Theory

Theory Textbooks

Textbooks Alan Marshall

Alan Marshall Gregory Brown

Gregory Brown Daniel Ruddy

Daniel Ruddy Dhaval Bathia

Dhaval Bathia D Brian Lee

D Brian Lee Sean Percival

Sean Percival Bradley T Erford

Bradley T Erford Helen Wattley Ames

Helen Wattley Ames Nadine Gonzalez

Nadine Gonzalez Dr Hulk

Dr Hulk Sean Robins

Sean Robins Paul Larosa

Paul Larosa B A Lovejoy

B A Lovejoy Mark Bryant

Mark Bryant Allan R Wallace

Allan R Wallace Amy Swenson

Amy Swenson James Roy

James Roy J B Fitzgerald

J B Fitzgerald Joshua Liljenquist

Joshua Liljenquist Misha Collins

Misha Collins

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Duncan CoxThe Time Traveler's Theory of Relativity: Unraveling the Secrets of Time and...

Duncan CoxThe Time Traveler's Theory of Relativity: Unraveling the Secrets of Time and...

Fletcher MitchellThe Vanished Blemished: Exploring the World's Most Perfectly Preserved Bodies

Fletcher MitchellThe Vanished Blemished: Exploring the World's Most Perfectly Preserved Bodies

Asher BellExpanding the Fretboard: Demarius Jackson's Revolutionary Approach to Guitar...

Asher BellExpanding the Fretboard: Demarius Jackson's Revolutionary Approach to Guitar... Gene SimmonsFollow ·18.5k

Gene SimmonsFollow ·18.5k Cody BlairFollow ·6.9k

Cody BlairFollow ·6.9k Jared NelsonFollow ·19.2k

Jared NelsonFollow ·19.2k Brennan BlairFollow ·6.8k

Brennan BlairFollow ·6.8k Roy BellFollow ·14.5k

Roy BellFollow ·14.5k Kirk HayesFollow ·7.9k

Kirk HayesFollow ·7.9k Chase MorrisFollow ·15.5k

Chase MorrisFollow ·15.5k Edward ReedFollow ·3.3k

Edward ReedFollow ·3.3k

Charlie Scott

Charlie ScottAn Extensive Guide to Road Races in the Southern United...

Welcome to the...

Seth Hayes

Seth HayesHow to Create Your Cosmetic Brand in 7 Steps: A...

The cosmetic industry is booming, with an...

Emilio Cox

Emilio CoxLean for Dummies: A Comprehensive Guide to the Lean...

Lean is a management...

Dashawn Hayes

Dashawn HayesThe Family She Never Met: An Enthralling Novel of...

Prologue: A Serendipitous...

Italo Calvino

Italo CalvinoThe Alluring Soundscape of Rickie Lee Jones: A Journey...

: The Enigmatic Soul of...

Fyodor Dostoevsky

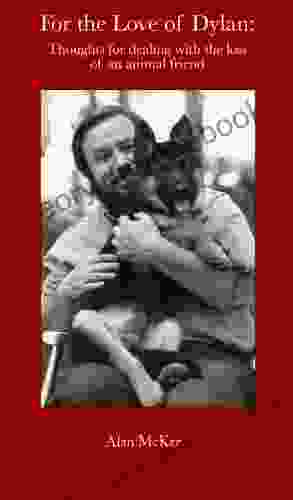

Fyodor DostoevskyFor The Love Of Dylan: An Exploration of Bob Dylan's...

Bob Dylan, the...

4.4 out of 5

| Language | : | English |

| File size | : | 10520 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 300 pages |